refinance transfer taxes virginia

In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. Some areas do not have a county or local transfer tax rate.

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

3 A The word deed means any document instrument or writing including a security interest instrument wherever made executed or delivered pursuant to which.

. Im having trouble finding a source that conclusively says refinancing is subject to transfer tax in VA. In the event of an open credit line or revolving deed. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Deeds of trust or mortgages. Delaware DE Transfer Tax. Ad We Can Refinance Your Home In About A Month.

Finally youll pay taxes on the real estate transfer. In Vermont the standard transfer tax for home buyers is 145 of the property value. Transactions 400000 and above are taxed at a rate of 145 of the purchase price.

City Transfer Tax paid by seller Transaction amount 400000 or above. Yet my lender says I have to pay transfer tax still. Virginia Code 581-803 A imposes the recordation tax on deeds of trust mortgages and supplemental indentures.

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. LendingTree Makes Your Mortgage Refinance Search Quick and Easy. 200 per 1000 is charged on new money difference of increase in loan amount if payoff lender and new originating lender are the same.

But if Im refinancing the title isnt changing hands. When providing a GFE disclosure for new Virginia refinances take note of changes on the way starting July 1 2012. Homebuyer may be eligible for reduced recordation tax of 0725 learn more.

The District of Columbia provides for exemption from Transfer and Recordation Tax on Deeds under 421102 of the Code for documents defined as Deeds below. Another fee is grantor tax which can be calculated as 01 or 050500 whichever is greater. State recordation tax is 025100 or 025 for amounts under 10 million and is usually paid by the buyer.

We want you to be aware of a change to Virginia Code 581-803D which concerns the calculation of recordation tax on a refinance deed of trust. All non Class 1 transactions. Just wondering if anyone knows off the top that transfer tax for refinance is actually valid in VA.

The cost is one percent or 1001000 of the transaction amount. 0 percent to 2 percent. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

Some states will add an additional transfer tax if you sell a property for 1000000 or more. Code 581-803 D when a deed of trust is used in refinancing an existing debt with the same lender and the tax has been previously paid on the original deed of trust securing the debt the recordation tax will not apply to the deed of. Original mortgage was for 500000 and the principle payoff is now 350000.

Apply Online To Refinance. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of the principal payoff and the new mortgage. For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes.

It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. State Transfer Tax is 05 of transaction amount for all counties. 13th Sep 2010 0328 am.

Im having trouble finding a source that conclusively says refinancing is subject to transfer tax in VA. 500 2 is 1000 and that would be what you owe in transfer taxes for the sale. Ad Compare top lenders in 1 place with LendingTree.

The State of Delaware transfer tax rate is 250. Im having trouble finding a source that conclusively says refinancing is subject to transfer tax in VA. Ad Best Mortgage Refinance Loan Compared Rated.

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. Comparing lenders has never been easier. If you sold the property for 250000 you would divide 250000 by 500 which is 500.

Title fees Attorney costs calculator VA Title Insurance rates. Old Dominion Title Escrow 2425 Boulevard Ste 5 Colonial Heights VA 23834 804-526-8000. Code 5131-803 D when a deed of trust is used in refinancing an existing debt with the same lender and the tax has been previously paid on the original deed of trust securing the debt the recordation tax will only apply to the portion of.

Except as provided in this section a recordation tax on deeds of trust or mortgages is hereby imposed at a rate of 25 cents on every 100 or portion thereof of the amount of bonds or other obligations secured thereby. Virginia closing costs Transfer taxes fees 2011. The DC Recorder of Deeds taxes purchase transactions on the purchase price or the assessed value of the property if the consideration is less than or equal to 30 of the assessed value.

State laws usually describe transfer tax as a set rate for every 500 of the property value. Transactions 647000 and below a first-time DC. Deed Tax 333 per thousand of the salespurchase price.

Purchase All counties use the same tax calculation for a purchase or refinance transaction. Virginia Code 581-803 A imposes the recordation tax on deeds of trust mortgages and supplemental indentures. It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save.

Counties in Virginia are allowed to collect one-third of the amount of the state recordation tax which would be 833 cents on every 100 Virginia Code 581-803 A. It is referred to as the mansion tax and it is typically one percent of the sale price. The home seller typically pays the state transfer tax called the grantors tax.

The Commonwealth of Virginia levies a tax of 25 cents on every 100 on the amount refinanced Virginia Code 581-803 A. When the same owner s retain the property and simply complete a refinance transaction no new deed is. For instance the transfer tax in North Carolina is described as 100 for every 500 a rate of 02.

Taxes are collected on a semi-annual basis. Transactions 399999 and under are taxed at a rate of 11 of the purchase price. Apply Online Get Low Rates.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. In the Northern Virginia region the Commonwealth levies an additional grantors tax of 015 per 100 or portion of 100 of the sales price or fair market value of the property excluding any.

In those areas the state transfer tax rate would be 300. Fairfax Circuit Court Land Records Recordation Taxes And Fees Page 1 CCR A-50 Effective 712021 Taxes and Fees Recordation Cost State 025 per 100 rounded to the next highest 100 581-801.

Va Termite And Pest Inspections List Of Requirements By State

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

Closing Costs That Are And Aren T Tax Deductible Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

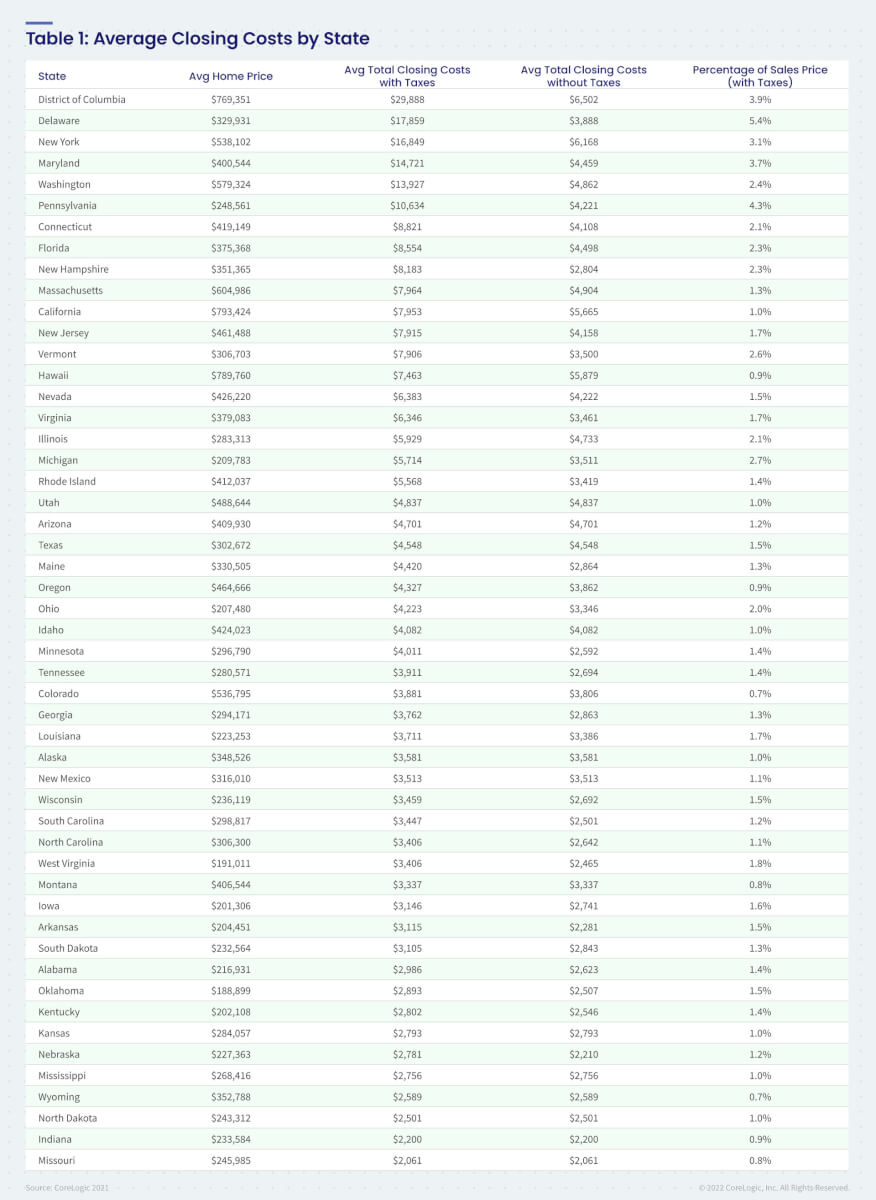

Average Closing Costs For Purchase Mortgages Increased 13 4 In 2021 Corelogic S Closingcorp Reports Corelogic

Virginia State Taxes 2022 Tax Season Forbes Advisor

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Penfed Credit Union Review Up To 2 500 Mortgage Credit Nextadvisor With Time

Virginia Real Estate Transfer Taxes An In Depth Guide

Virginia Closing Costs Taxes Va Refinance Purchase Estimate

West Virginia Real Estate Transfer Taxes An In Depth Guide

Compare Today S Mortgage Rates In West Virginia Smartasset

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements