costa rica taxes for us expats

Our team of US tax professionals has decades of tax preparation. Employees in Costa Rica contribute 917 of their earning to the Costa Rican social security system.

Us Expat Taxes For Americans Living In Costa Rica Bright Tax

Tax International based in San Jose Costa Rica specializes in helping US.

. In addition to the income tax the only taxes Americans living in Costa Rica are likely to encounter are. It is a tourist. The major differences between the two countries are their tax years.

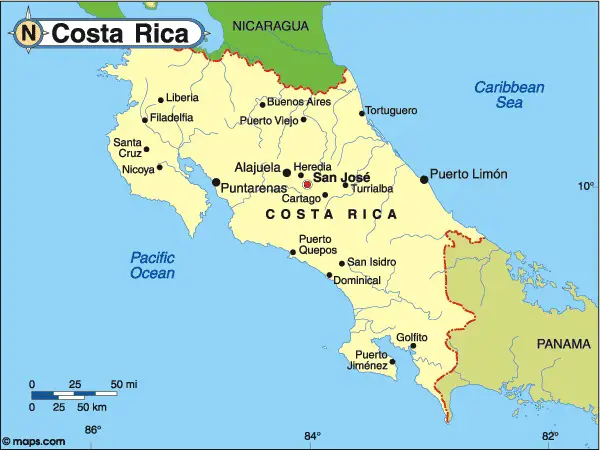

Tamarindo has one of the best and tranquil beaches found in Costa Rica. Non-active corporations have to pay 15 of minimum wage yearly 63750. The city lies on the Pacific coast of Costa Rica and its considered a safe place in Costa Rica.

The pros and cons costs where to live residency and property matters and many more. Easy Costa Rica Tax Guide for US Expats Abroad. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value.

The US tax system looks at it this way a liability of 100000 400000FF divided by. Whats more new inversionista rentista. The minimum income amount for filing in 2022 so your income in 2021 depends on your income type.

Topics covered include public CAJA hospitals vs. A complete expat guide to moving to and living in Costa Rica. The period covers the months from January to December while the tax returns for US expats are due June 15.

8 Things to Know About Tax Returns Feb 13 2022 Americans Working Abroad 25 Things You Need to Know About US Expat Taxes in 2022. While there are many different countries that US Person Expats travel to in recent years Costa Rica has become one of the most popular. Active corporations that earn up to 51 million have to pay 25 of minimum.

Citizens living overseas comply with. Due to lower interest rates he decides to refinance on 112002 when the exchange rate is 5FF to 1USD. If you earn more than 12550 total income globally you will be required.

May 26 2022. Expats discuss their experiences giving birth in Costa Rica. 8 Things to Know Before Having a Baby in Costa Rica.

USTaxGlobal provides Simple Secure Affordable tax preparation services to US expats all around the globe. Tax and Accounting Services Company based in San Jose Costa Rica. Allyson Lindsey Managing CPA and Partner at BrightTax a leading provider of US expat tax services provides us with some US tax tips for Americans living in Costa Rica in.

Embassy and the Costa Rican chapters of Democrats Abroad and Republicans Abroad are available to help citizens register to vote abroad no political affiliation necessary. Corporation Tax Rates in Costa Rica. Costa Rican Taxes for US.

Expats living in San Jose Costa Rica only pay Costa Rican taxes on any income they may have that originates in Costa Rica but US taxes on their worldwide income. In other words this is truly a law to attract new investors and retirees rather than a complete change to Costa Ricas immigration laws. Costa Rica didnt have a capital gains tax except for developers until 2019.

Foreign Tax Credit When it comes to US expat tax in Costa Rica most US expatriates worry about double taxation paying taxes to two different countries the US. The capital gains charge is 15 for residential properties and 30 for commercial properties. Here are the main types of taxes you have to pay in Costa Rica depending on how you make money.

Costa Rica Eldercare And Assisted Living For Expats

International Taxes In Costa Rica What You Need To Know

A Beginner S Guide To Costa Rican Tax For Us Expats

Who Pays Taxes In Costa Rica Costa Rica Mls

The Taxation System In Costa Rica Tax In Costa Rica

Costa Rican Taxes For U S Expats 8 Things To Know About Tax Returns

What Are Property Taxes Like In Costa Rica Mansion Global

How To File Us Taxes When Living In Costa Rica Online Taxman

Costa Rica Cost Of Living 2022 How Much To Live In Costa Rica

Taxes In Costa Rica International Living Countries

A Beginner S Guide To Costa Rican Tax For Us Expats

How Is Rental Income Taxed In Costa Rica Costaricalaw Com

![]()

What You Need To Know Before You Move To Costa Rica Costaricalaw Com

New Taxes And Obligations In Costa Rica Know Before You Invest

What You Need To Know Before You Move To Costa Rica Costaricalaw Com

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

12 Top Expat Tax Tips And Services For Living In Costa Rica

Tax Guide For Americans Living In Costa Rica Greenback Expat Tax Services

5 Best Travel Insurance Options For Expats And Travelers Health Insurance Infographic Health Insurance Travel Health Insurance